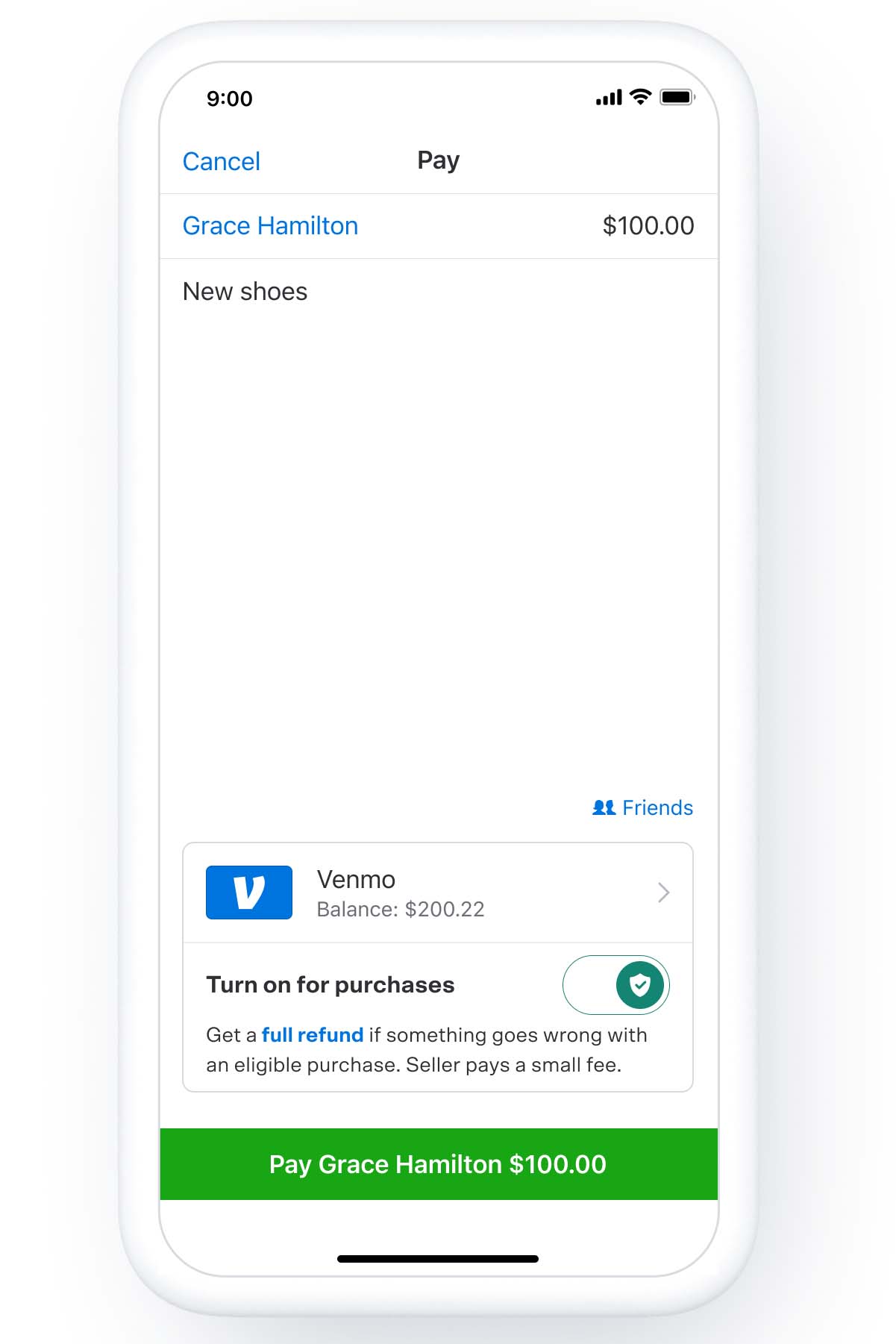

Venmo Tax Limit 2025. The problem with this new rule is that it may result in tax penalties. By default, venmo will issue tax.

For tax year 2025, the child tax credit is $2,000 per child, age 16 or younger. Simple tax filing with a $50 flat fee for every scenario.

First introduced in 2025, the internal revenue service (irs) had intended to implement a new reporting rule requiring payment apps like paypal, venmo, cash app,.

Venmo Credit Limit Everything You Need to Know (2025), 6, 2025, 1:54 pm pst. Tap the settings gear from your profile tab.

Venmo Tax 2025 Tax TaxUni, A new rule requiring venmo to issue tax forms for transactions of $600 or more in a year was initially set to go into effect for the 2025 tax year. Current law is included in schedule 1 and schedule.

Venmo Tax Reporting, The IRS, And 1099K Forms What You Need To Know, For tax year 2025, the child tax credit is $2,000 per child, age 16 or younger. Irs officials say one reason for the delay is taxpayer confusion.

Venmo Taxes How to Report Your and Avoid Penalties?, A new rule requiring venmo to issue tax forms for transactions of $600 or more in a year was initially set to go into effect for the 2025 tax year. Yahoo personal finance · getty images.

Venmo Tax Reporting for Personal Use Does Venmo Report to IRS, Simple tax filing with a $50 flat fee for every scenario. The irs has revised its frequently asked questions for.

"Unlock the Best Venmo TaxFree Transfer Limit for 2025 How Much is, New irs rules for 2025 and 2025. That rule has been delayed by one year to.

Press Release How to Confirm Your Tax Information to Accept Goods, However, it’s important to note this delay is. The changes to both the registration and deregistration thresholds will take effect from 1 april 2025.

Taxes on Venmo Transactions..? (Everything You MUST Know) YouTube, Venmo transactions and venmo taxes implications. For 2025, the basic reporting threshold will be increased from $600 to $5,000, the irs said.

*NEW* IRS Reporting Threshold…? Venmo Taxes 2025 UPDATE! YouTube, Current law is included in schedule 1 and schedule. Enter a name for your tax, keeping in mind that customers will see this tax name on their receipt.

Press Release How to Confirm Your Tax Information to Accept Goods, Irs officials say one reason for the delay is taxpayer confusion. The irs is piloting a free technology for taxpayers to file tax returns directly with the irs in 12 states, including massachusetts and new hampshire.

The agency expects a threshold of $5,000 for the 2025 tax year, which will help transition to the $600 reporting threshold.

Equipment Rental WordPress Theme By WP Elemento